Apply today

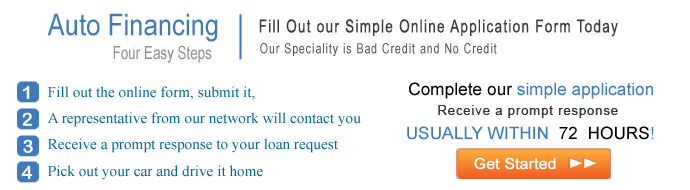

Auto Financing

For Your Next Car

Looking For A 72 Month Auto Loan? Learn How To Get One Now

It’s important that you do some research on 72 month auto loan rates when you are out for finalizing a deal with a lender. There may be numerous factors which a borrower needs to consider at the time of choosing any auto loan that has duration of 6 years. The term may be too long for making commitment and to that effect, even the vehicle being preferred will assume significance.

Obtain A Quick 72 Month Bad Credit Auto Loan Online Today

Finding the best used or new car rates for 72 months can be challenging if you have bad credit. However, your task could be much easier if you considered the below mentioned parameters.

- Down paymentg

if you indicate willingness to pay a sizable amount of down payment on your car loan, most of the lenders will approve your application almost instantly. Besides, such a proposition will need you to borrow less money for financing car. - Get a cosigner

Majority of the loan dealers will grant instant approvals to your auto loan application if you get a cosigner, who has good credit reputation, to cosign the car loan. This assures lenders that the money being lent is totally recoverable. - Loan-To-Value (LTV) Ratio

You could receive a quick approval for your 72 month auto financing loan application if your LTV ratio is low. This is because lower LTVs provide assurance to lenders that the borrower is likely to default on his loan payments.

4 Key Benefits Offered By The Best 72 Month Car Loans Online

If you can qualify for the lowest rate of interest on a 72 month car financing loan, you could secure an array of advantages as follows.

- Lower monthly payments - if you have fixed monthly income then a 72 month auto finance loan could be one of the most viable options for you as it will have low monthly installments that might fit your budget.

- Keep vehicle for long time - On account of a 72 month loan term, borrower has the chance to keep his car for a much longer time period. But he must ensure that he maintains regularity in paying the monthly installments.

- Refinancing is an alternative - it could be always possible to get your vehicle refinanced at lower interest rate and shorter term since 72 months can be too long a period for repaying the loan. Refinancing can help save money.

- Other beneficial purpose - Borrower can make a onetime investment in the form of a new or used car despite having fixed monthly income and small amount of savings. Besides, lower monthly payments can be easily managed and sustained.

5 Important Tips For Finding The Lowest 72 Month Auto Loan Rate

To obtain the best auto loan rates 72 months, it could be important for you to consider the following aspects.

- Become member of a local credit union

The best 72 month auto loans could be provided by credit unions so you could consider becoming a member of some local credit union few months before you apply for a loan. - Make sure that your credit rating is good

if your personal credit profile is good, you could easily obtain the lowest interest rate on a 72 month car finance loan with even the car maker’s in-house lending services. - It is advisable to wait until you get a great offer

Major car manufacturers offer 0% car loans although they may not extend such proposals for 72 months. But few dealers advertise low 72 month new car loan rates for even bad credit, just find them. - Search for specialized online car loan dealerships

Find local lenders that specialize in providing car loan finances at lower rates of interest with 6 year durations to even those borrowers who have bad or no credit ratings - Determine the right type of vehicle for your situation

Lenders may not be willing to offer auto loans with 6 year durations for any vehicle. You need to ensure that you select the right type of car for your situation.

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.