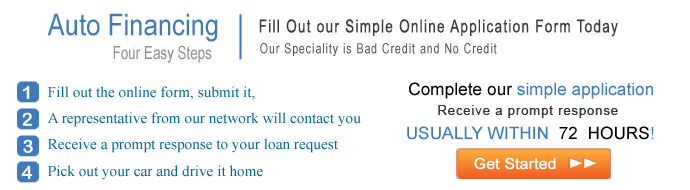

Apply today

Auto Financing

For Your Next Car

High Risk Car Loans? Often Advertised, but LoanexFastCash Delivers!

High risk auto loans for those with bad credit, bankruptcies or repossessions in their past are advertised on internet lender websites. It’s easy to offer them, but which of the high risk auto financing sites really delivers the loans? At the LoanexFastCash.com our network of high risk auto loan lenders works hard to get you the loan while helping to rebuild your damaged credit.

High Risk Auto Financing is a specialty!

Auto financing, high risk is a special type of auto lending. For those with FICO scores below 625 getting a car loan can be a real problem and many Americans because of the economic struggles of the past 5 years find themselves in that position. So, what are they to do, having poor credit doesn’t mean you don’t need reliable transportation!

- LoanexFastCash has dealers who specialize in loans of this type, our dealer lender network has many who obtain loans for their customers despite low credit scores.

- Dealers that don’t report on time payments may give you the loan, but they won’t improve your credit. LoanexFastCash’s dealers always do a credit check and report the payments.

- Experience and professionalism count, LoanexFastCash helps you get the loan at competitive rates. High risk loans do carry higher rates!

- At LoanexFastCash our application is simple, SSL secure and never asks for more than we need to know!

What does it take to get a high risk car loan?

- Income requirements may vary, but in general a minimum income of $1800 is required. The lower the credit score, the higher the monthly income that is desirable. Self- employed people will need to provide the previous 3 years tax returns.

- If you have a bankruptcy in your past all terms of the bankruptcy must be discharged unless you have sufficient income and have received permission in a Chapter 13 bankruptcy.

- No repossession are allowed unless they have been part of a bankruptcy decree.

- You must be at least 18 years of age and able to provide rent receipts or utility bills to prove residence.

Each dealer lender may have some additional requirements to qualify for a high risk loan. Length of employment and residence may also be factors which they consider for approval of an auto loan. When you are contacted, you can ask the finance professional for any additional requirements.

Your car loan and your credit!

Credit scores and credit history can make your life easier or more difficult! Having good credit can have an impact on where you live, where you work and your lifestyle in general. Bad credit is not permanent, it can be rebuilt and one of the best ways is with an auto loan. On time payments and satisfactory completion of an auto credit contract can make a difference! Let a LoanexFastCash dealer/ lender help you to a better credit score and a better life!

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.