LoanexFastCash - A Bankruptcy Car Loan Services Company

The.LoanexFastCash.com represents leading bankruptcy car loan services companies whose specialty is working with debtors who have filed for Chapter 7 or Chapter 13 bankruptcy. If you’re currently involved in a bankruptcy and need a car, The LoanexFastCash.com’s network of financing specialists provide services that are tailor made for your needs.

Auto Loans after Bankruptcy - The LoanexFastCash can help!

If your bankruptcy period is over, it’s possible to get auto financing for the car you want and without a lot of hassle. It’s as straightforward as that! Our network can help in getting almost instant car loans during the bankruptcy period. Every year, many individuals benefit from the work hard of our professionals in auto financing. Taking advantage of our services to get your next car loan can be so easy with The LoanexFastCash.com.

LoanexFastCash - Bankruptcy Auto Loan with Blank Check services

Getting a car loan during bankruptcy can be trying for most debtors facing a legal ordeal and tough financial conditions. One way of meeting your commutation needs is to get a blank check option to buy your car. Its a facility in which the applicant has to pre-qualify for the credit facilities, and get the credit before actually buying the car. Its possible to buy new, as well as used cars through this facility. Whats more, similar credit facilities are available for getting car loans after bankruptcy, so if your bankruptcy process is through you are still eligible for it. The entire application process is very easy and convenient. The main advantages of the blank check option are:

- Save funds

You can finance your car with a low APR and get your blank check the next day

- Save time

You don’t have to spend time and resources in getting a car loan after bankruptcy

- Regain control

Stay in command and control your situation. You don’t have to depend upon auto dealers and moneylenders by submitting your loan application, which can be subsequently rejected. You also benefit in getting the best price for your car, since you are making a total payment for your car, and not availing the monthly installment facilities.

How to qualify for loans with Chapter 13 Bankruptcy

It’s important to qualify for car loans with bankruptcy and not every debtor gets approved for a loan just by completing the application. One has to prepare for obtaining car loans while in bankruptcy in an organized manner. If your credit ratings and FICO scores are low, its recommended you apply for a bankruptcy auto loans. Several loan providers have a special qualification process for individuals with poor credit scores. It requires an authorization from the trustee appointed by the bankruptcy court before actually buying your car. If you’ve filed for Chapter 13 bankruptcy, it’s not that difficult in getting the permission, since the chapter supports the debtor in maintaining all non-exempted assets, as long as the credit history indicates regular monthly payments. In such cases, it becomes easier to take advantage of an after bankruptcy car loan. In this process, one has to submit the monthly payment report to the creditor.

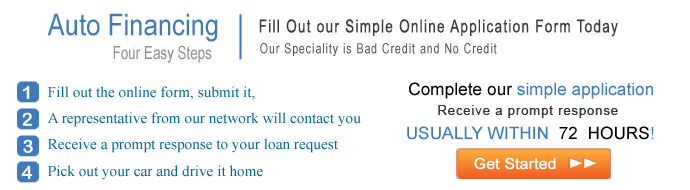

Get approved for car loan in 48 Hours regardless of credit history

Apply today

Auto Financing

For Your Next Car

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.