- Car Loans

- Bad Credit Car Financing

- Subprime Auto Loan

- No Money Down Car Loan

- No Credit Car Loans

- Second Chance Car Loans

- Types of Car Loans

- First Time Buyer Auto Loan

- Secured Car Loans

- Military Auto Loans

- Pre Approved Auto Loan

- Student Auto Loan

- Private Party Auto Loan

- No Cosigner Car Loan

- Watch the Video

Apply today

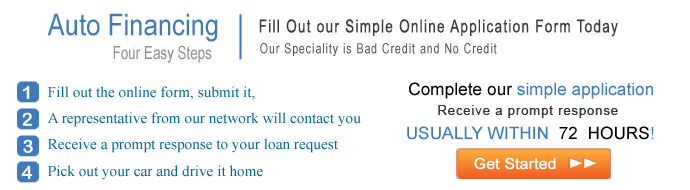

Auto Financing

For Your Next Car

Time Period Required for Post Bankruptcy Auto Loans

US economy and financial condition has not yet attained the stability which is otherwise required so that businesses can run smoothly and without seeking any federal help. As it is evident, many individuals in recent times have gone bankrupt and the number of individuals who apply for Car Loans after Bankruptcy have surged. You may find there is a line of auto finance borrowers, who have bad credit score, discharged bankruptcies, and some of them even have undischarged bankruptcies. As the result, the auto loan financiers have become little manipulative so that they can easily handle bankruptcy situation. You don’t need to worry. Being bankrupt will not mean that you cannot buy a car or the lender will ignore your loan application. There are lenders who will not see you as their prospective customer, but still, you will come across many high risk lenders who will happily offer you the loan. Of course, the auto finance offered to you in this situation will be at high interest rates. Again, you many even go for in house auto financing as they will also be the right means to lend you auto financing, ignoring your current financial situation.

Just be ready to buy Bankruptcy auto finance from your lender. It will not take more of your time, provided you follow all the other relevant details. Bankruptcy is a serious condition and you cannot take serious condition in a light mood. Due to weak prevailing financial conditions, many people and businesses have become bankrupt over a period of time. Most of the bankrupt individuals are finding the ways to improve or rebuild their failing credit score, and it is here that the role of bankruptcy auto finance comes into play. Bankrupt individuals can also become proud car owners, and they can also get the chance to improve their credit history. It is significant to know that you talk and discuss with experienced bankruptcy auto finance lender. This will help you to get the right way of doing the things in a better way, even if you have filed for bankruptcy.

Get approved for car loan in 48 Hours regardless of credit history

Bankruptcy and Auto Loans often go hand in hand for the bankrupt individuals who are more than eager to search for bankruptcy lenders to buy the loan. Such lenders will offer you cheaper vehicle auto financing. Wait for 2-3 years after bankruptcy has been discharged during which time you can rebuild your credit so that the lender offers you loan at low interest rates.

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.