- Car Loans

- Bad Credit Car Financing

- Subprime Auto Loan

- No Money Down Car Loan

- No Credit Car Loans

- Second Chance Car Loans

- Types of Car Loans

- First Time Buyer Auto Loan

- Secured Car Loans

- Military Auto Loans

- Pre Approved Auto Loan

- Student Auto Loan

- Private Party Auto Loan

- No Cosigner Car Loan

- Watch the Video

Apply today

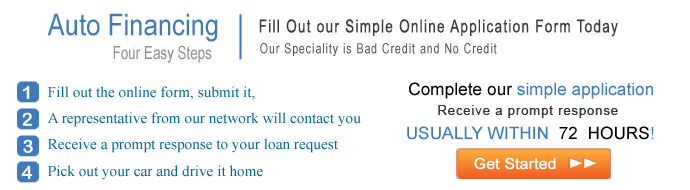

Auto Financing

For Your Next Car

Is a 72 Month Auto Loans the Right One for You?

As manufacturers produce vehicles that last longer and carry drive train warrantees up to 100,000 miles, the 72 month auto loan for those who want them can be a real advantage. Today’s cars and trucks last longer, and for those people who have a fixed transportation budget with a willingness to keep their cars longer, the 72 month car loans available can allow them to buy more vehicle for the same dollar amount.

Advantages of a 72 Month Used Car Loan

- The longer repayment period can provide the buyer with a lower payment helping those who are on a fixed income or those who wish to keep their transportation budget within strict limits to provide cash for other things.

- A loan of this length can allow the individual the option of buying a newer or upgraded vehicle while keeping the payments within the budgeted amount.

- Remember that a loan of this length can be refinanced to a shorter term should circumstances change.

How to Get the Best 72 Month Auto Loan Rates

- A place to begin to look for a loan of this type is a local credit union which frequently offers some of the lowest rates on loans of this type to its members.

- Know what your credit score is and obtain copy of your credit report. Extended loans like this one require a higher score or a larger down payment.

- Shop for the best rate, you will frequently see advertisements for rate sales particularly for extended length loans like this.

- Online lenders are a good source for loans of this type. You can begin you search right here at the LoanexFastCash.

- Finally, take care of your vehicle. No one wants to be paying for a car that has become a maintenance problem, doing your research beforehand can prevent you from buying a vehicle with a poor maintenance record.

Getting a 72 Month Auto Loan with Bad Credit

A 72 month auto loan exposes a lender to someone with bad credit to an extended period and a higher risk because of the length of the re-payment. Therefore, those buyers with bad credit may find obtaining a 72 month loan more difficult and they will certainly find that interest rates for such a loan are considerably higher than a comparable loan to a person whose credit is good. But, using some of the steps for getting the best loan rate mentioned above can also help the borrower with bad credit to obtain the best loan possible.

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.