- Car Loans

- Bad Credit Car Financing

- Subprime Auto Loan

- No Money Down Car Loan

- No Credit Car Loans

- Second Chance Car Loans

- Types of Car Loans

- First Time Buyer Auto Loan

- Secured Car Loans

- Military Auto Loans

- Pre Approved Auto Loan

- Student Auto Loan

- Private Party Auto Loan

- No Cosigner Car Loan

- Watch the Video

Apply today

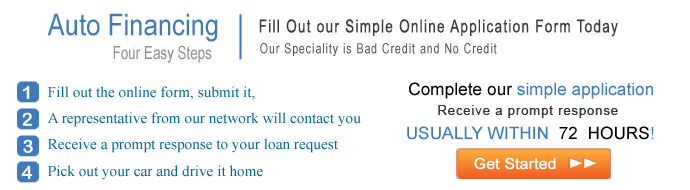

Auto Financing

For Your Next Car

A 60 Month Car Loan? That’s About Average by the Latest News from Credit Agencies!

The days of the 48 month car loan are long gone, in September of 2012, the average auto loan length had increased to 63 months. Statistics showed the decline in four year loans while showing increases in both the 5 and 6 year loan categories. Two possible reasons are the increased costs of both new and used vehicles and the auto industries improved quality, extended warrantees and vehicles that simply last longer. Advantages of 60 month used car loan rates include:

- More affordable payments on more expensive vehicles, longer warrantees protect even used car buyers with factory coverage for some repairs, and quality and construction improvements have increased vehicle longevity.

- The ability to refinance the loan as it is paid off to obtain a lower interest rate or lower payment.

Getting the Best from a 60 Month Loan on Your Next Car!

New or used cars loans at 60 months are best if you do the research first and the best place to begin is with:

- Your credit report, knowing what it contains and checking it over to see if there are any errors is always good advice. Errors need to be corrected and understanding that a 5 year loan will require better credit is important before you apply.

- Shop for the best rates, they maybe at a credit union or bank but don’t count out online car loan companies and the dealers with whom they work as you shop.

- Know your budget, how much car can you afford. Don’t forget that insurance is an important factor in your total monthly cost. A newer car’s insurance will be higher than your resent one may be and the lender may require coverage you don’t currently have.

- Research the cars, new or used you want to be sure that the vehicle will be reliable for the length of the loan. Ther are many websites on the internet as well as print publications which can tell you about the maintenance history of a particular vehicle.

- Go shopping for that car and find the one that’s right for you. Be ready with all the information you’ll need. Paycheck stubs, rent receipts or utility bills may be required as you negotiate the sale.

The LoanexFastCash can provide competitive 60 Month used car interest rates as well as 5 Year rates for new cars!

The decision is yours, 60 month loans were once a rarity but they are now the norm according to Experian which reported the average loan to be 63 months in length in September of 2012. The longer period allows you to have a lower payment and with the ability to refinance cars in today’s marketplace it may be the right decision for you!

The application is simple, the site SSL secure and we never ask for more info than we need! Apply today!

The LoanexFastCash.com Services

Car Loans | Auto Refinancing | Auto Insurance | Mortgage Refinance | Loan Modification | Debt Consolidation | Debt Settlement | Filing Banlruptcy

Privacy Policy | Terms of Uses | Contact LoanexFastCash.com

The LoanexFastCash's technology and processes are exclusively owned and Copyrighted © by LoanexFastCash.com - 2005-2024. All Rights Reserved. This site is directed at, and made available to, persons in the continental U.S.